Africa’s rapidly growing economy, driven by a young, dynamic population, abundant natural resources, and rapid urbanization, is a prime investment destination. Key drivers include increasing consumer spending, infrastructure development, and a burgeoning middle class. The diverse economy offers business opportunities in Africa across various industries including energy, infrastructure, telecommunications, and agriculture. Renewable energy, infrastructure development, and telecommunications are attractive sectors. Agriculture remains a cornerstone, offering vast agribusiness investment opportunities. By strategically allocating investments in key sectors, investors can realize significant returns and contribute to sustainable development.

Limited capital presents numerous business opportunities in Africa, necessitating strategic thinking and high returns. Micro-investing platforms, crowdfunding, exchange-traded funds, and peer-to-peer lending platforms offer exposure to African markets. Credit and risk understanding is crucial. Thorough research and consulting with a financial advisor are essential before investing.

Micro-investing platforms in Africa have democratized access to financial markets, particularly for those with limited capital. These platforms offer fractional investing opportunities, enabling users to invest in stocks, funds, or other assets with minimal funds. This accessibility is particularly beneficial for those who find traditional investment options inaccessible due to high minimum investment requirements or other barriers. Micro-investing platforms contribute to local economies’ development, benefiting individual investors, supporting economic growth, and job creation.

Crowdfunding platforms offer a platform for entrepreneurs and investors to support African startups and small businesses, democratizing access to funding. These platforms allow investors to contribute small amounts to projects they believe in, potentially earning high returns if the venture succeeds. However, due diligence is crucial, including researching the project, assessing the business model, and evaluating the management team’s capabilities. Diversifying investments across multiple projects can spread risk and increase positive returns over time.

Exchange-traded Funds (ETFs) focused on African markets provide a convenient and accessible way for investors to participate in the continent These funds track the performance of indices or sectors in Africa, providing diversified exposure to the continent’s economy. Investing in ETFs allows investors to tap into Africa’s growth potential, as it is home to some of the world’s fastest-growing economies and emerging markets. They are straightforward to invest in, requiring minimal expertise in individual stocks or markets, and are traded on stock exchanges, making them easy to buy and sell through brokerage accounts.

Peer-to-peer lending platforms in Africa are a popular alternative financing option, connecting investors with borrowers for a more direct and streamlined process. These platforms offer interest payments made by borrowers, with rates varying based on factors like creditworthiness, loan term, and market conditions. Diversifying lending portfolios across multiple borrowers can mitigate default risk. Despite the potential for attractive returns, peer-to-peer lending platforms carry inherent risks, including borrower default.

Investing in Africa presents opportunities, but it’s crucial to balance returns with risk. Low-risk investments include government bonds, stable industries like telecommunications and consumer goods, real estate investment trusts (REITs), and blue-chip companies. Government bonds offer stable returns, while stable industries have established revenue streams and strong market positions. REITs provide exposure to the real estate market and offer liquidity. Blue-chip companies, with stable earnings and dividend payments, can mitigate risk. Diversifying these low-risk opportunities allows investors to capitalize on Africa’s growth potential while minimizing downside risk.

Business opportunities in Africa are abundant and diverse, with sectors ranging from technology to agriculture experiencing growth and attracting investment interest. Investment platforms and apps in Africa are leveraging low-cost structures and user-friendly interfaces to offer investors access to the best investments. Platforms like EasyEquities Africa and Bamboo allow investors to explore opportunities beyond their local markets. Mobile payment platforms like M-Pesa, Paga, and EcoCash also facilitate investment. Despite challenges like limited internet connectivity and regulatory hurdles, these platforms continue to expand their reach and contribute to the investment landscape’s growth.

Agricultural, renewable energy, and technology sectors represent some of the best investment opportunities in Africa due to their potential for growth and profitability. Agriculture can be a profitable investment for large-scale commercial farming and agribusiness ventures, while renewable energy presents significant investment potential through public-private partnerships and utility-scale projects. The technology sector, attracting venture capital and private equity, can be tapped into fintech, e-commerce, digital infrastructure, and software development. However, challenges like access to finance, infrastructure, and climate change resilience must be addressed. Thorough research, understanding of market dynamics, the regulatory environment, and risk factors are crucial for informed investments. Investors can mitigate risks and maximize returns by diversifying their portfolios and staying informed about market trends.

Research is crucial for making informed investment decisions in Africa, especially in the diverse market landscape. Online resources like market reports, industry analyses, and financial news websites can be used to research potential investment opportunities. Financial advisors specializing in the African markets can provide personalized investment advice. Thorough due diligence on companies and sectors is essential, including analyzing financial statements, assessing management teams, evaluating competitive positioning, and understanding market dynamics. Look for companies with strong fundamentals, sustainable business models, and growth prospects aligned with investment objectives. Evaluating political and economic stability in African countries is also essential, considering factors like political institutions, governance frameworks, rule of law, macroeconomic indicators, and geopolitical risks.

In conclusion, Africa presents numerous investment opportunities in agriculture, renewable energy, and technology. Investors should conduct thorough research and due diligence to identify promising opportunities. Online resources, financial advisors, and market analyses can help navigate the diverse African market. However, it’s crucial to approach investing with caution and diligence, diversifying across sectors and asset classes, and employing effective risk management strategies. This will mitigate potential risks and enhance returns. By seizing opportunities in Africa’s dynamic economy and emerging markets, investors can contribute to economic growth, build wealth, and achieve their financial goals.

1. How can I invest in Africa without a lot of capital?

Investing in micro-investment platforms, crowdfunding, ETFs devoted to Africa, and peer-to-peer lending are accessible options.

2. What are some low-risk investment opportunities available in Africa?

Blue-chip companies, government bonds, and real estate investment trusts (REITs) are all good investments.

3. Are there investment platforms or apps specifically designed for the African market?

African investors have access to platforms like EasyEquities Africa and Bamboo, offering easy and user-friendly features.

4. What are some popular investment sectors in Africa for beginners?

The agriculture, renewable energy, and technology sectors all offer significant growth potential for beginners.

5. How do I research potential investment opportunities in Africa?

Research African markets thoroughly by using online resources like market reports, investment forums, and consulting financial advisors.

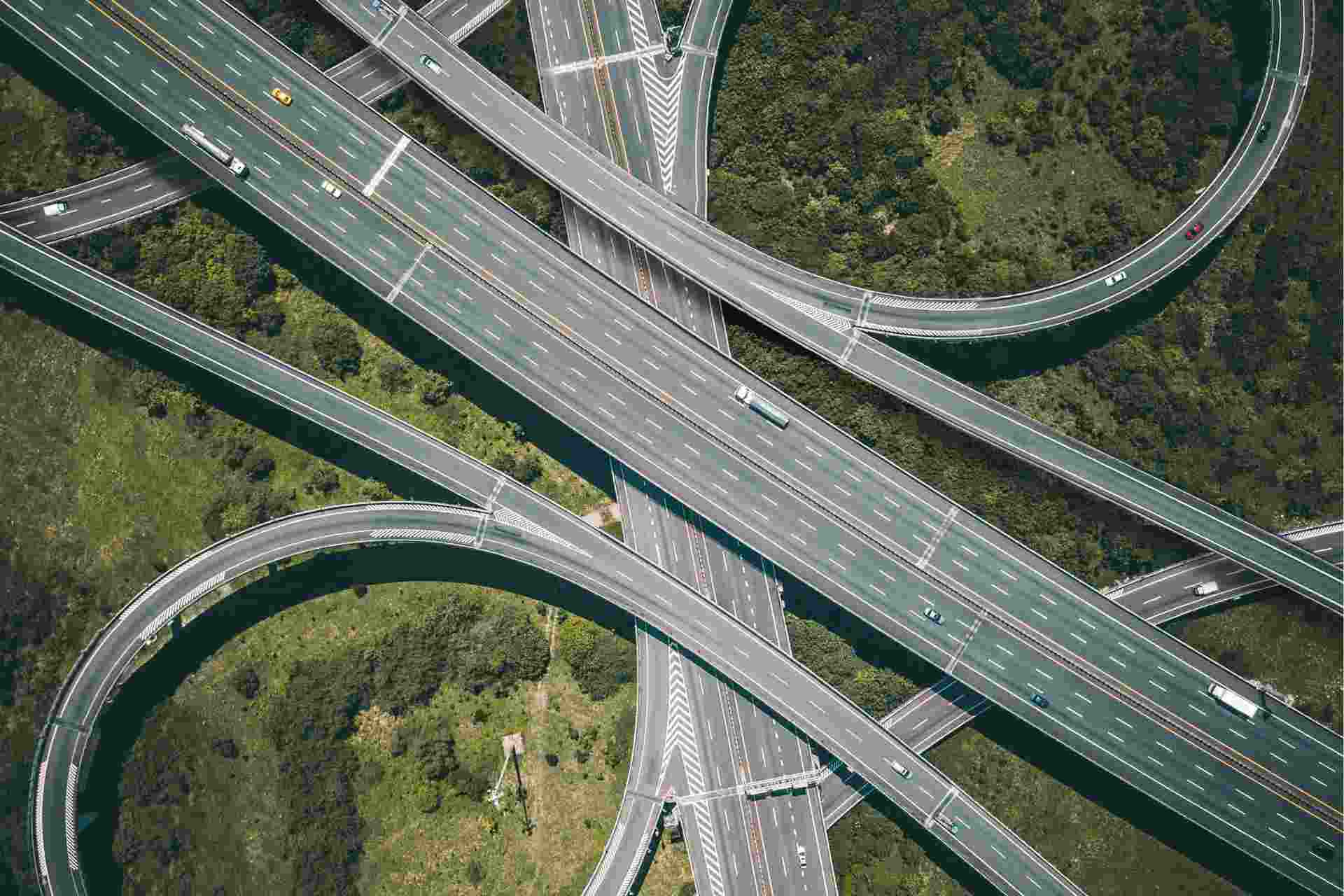

Infrastructure isn’t flashy, but it’s the backbone of real transformation and help to boost the investment opportunities in Africa. And a handful of African nations are making headlines with rapid progress across transport, energy, digital networks, and urban infrastructure. Based on the Africa Infrastructure Development Index (AIDI) 2024, here’s a sharper, more competitive story. Top […]

African stock markets aren’t just quietly doing well, they’re making a scene. And not the kind you ignore. If you’ve been on the sidelines waiting for a sign, well… here it is. Whether you’re seriously scouting investment opportunities in Africa or just trying to make sense of where the smart money is headed, Africa’s financial […]

Africa isn’t just “catching up” in the clean energy race. It’s flipping the whole script. The continent is moving from diesel to renewables, from scarcity to surplus, and from overlooked to overflowing with opportunity. Investors? Innovators? Governments? Everyone’s starting to wake up. This isn’t some distant dream, it’s the next gold rush. And it’s already […]